What started off as a quest to evaluate FOSS money management apps ended up revealing an issue with PayPal that plagues even highly funded proprietary money management programs running on that other operating system.

This is both a review and a complaint, which often seems to go hand in hand in the tech world.

I’ve been looking for a financial management app recently. Since I closed a bricks and mortar store back in 2012 — after eight years it became yet another victim of the 2007 recession — I’ve been letting my business and personal bank accounts, along with my PayPal account, sort themselves out separately. Business has improved a bit recently, and the time has come to once again put all of my accounting eggs in the same basket, so to speak.

My plan was supposed to be easy, but you know what they say about well laid plans.

I first installed about five free and open source money management apps on a test machine for a look, weeding out the ones that are too simple to handle both personal banking and the requirements of small businesses. I also took a pass on those that were much too unintuitive to be easily learned. As well, I didn’t bother to check out GnuCash, which I’d used at the old store and even before, because I now want something that requires a little less manual input.

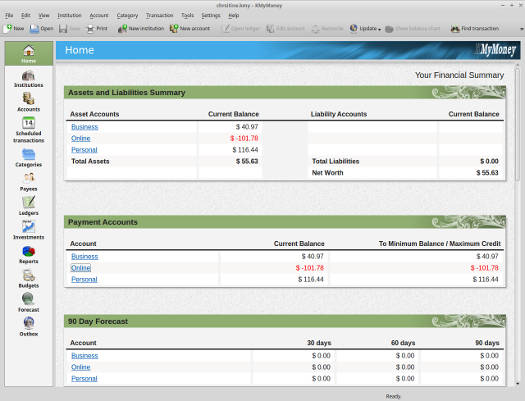

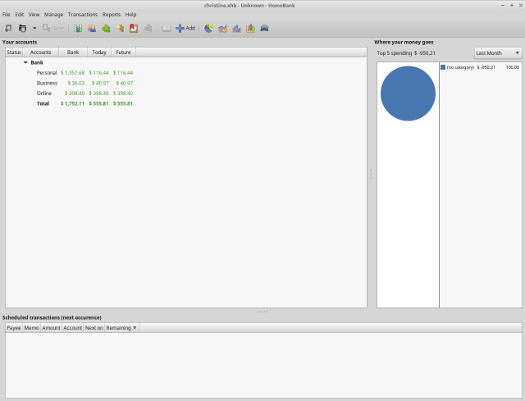

I settled on two finalists, the KDE app KMyMoney and HomeBank. I installed both on my main machine for a side by side comparison.

Although the two apps are dissimilar in many ways, below the surface there’s not a dime’s difference between the two and using one is much like using the other. Both offer pretty much the same abilities to keep track of both personal and lightweight home business finances, with documentation that’s not too bad once you get around the fact that their users’ guides assume you’ve already read the developers’ minds — a common problem with open source documentation. Once you get around that, however, the documentation becomes fairly complete and useful. As always, the forums help.

After taking enough time to figure my way around in each program, I configured three bank accounts in each, to include my personal and business accounts, as well as PayPal. Always being a bit paranoid, I left the account numbers in each blank, and instead of identifying each account by the name its institution, I used the headings “Personal,” “Business” and “Online.” I decided to use the beginning of the year as the start date, and duly entered the start of the year balance in each account as the starting balance.

Then it was off to my bank’s website to download my transactions for the year.

The bank offered several formats for downloading and I chose CSV, as I wrongly figured that would be the easiest option. The trouble was that HomeBank didn’t like the CSV files offered and said they were an “unknown or invalid file type,” even though the app is supposed to support the format. This caused me to switch horses in mid gallop and download QFX files instead. Then I crossed my fingers, held my tongue just right and one-by-one imported from both bank accounts into both applications.

That went well, with the ending balance of both accounts in both programs being precisely right, which is pretty much a requirement for a financial program. I was feeling confident. One more download and import, and I could go about the business of finishing configuring whichever program I was going to keep.

Christine’s rule number twelve: Never get confident when halfway through a never done before task on a computer. Reference Murphy’s law for details.

It was time for PayPal, which offers something short of a ton of download options. As QFX wasn’t one of them, I chose QIF and downloaded from the beginning of the year to the present. I imported into HomeBank first, because that was the application that I was beginning to favor. The importation seemed to go smoothly and I was ready to celebrate, until I looked at the ending balance, which was a little less than $400 instead of the more than $1,500 that was actually there.

Hmm… It was time to try KMyMoney to see if it did any better. It didn’t. It returned the exact same result.

A quick comparison of the imported transactions with the transactions listed on PayPal revealed the problem if not the cause. Numerous transactions were completely missing from the QIF file I was importing into the money apps.

The cause was easily found with a single Google, as this has been a problem plaguing business owners trying to sync PayPal accounts with accounting applications for years. It seems that whenever a customer is refunded, PayPal marks that transaction as “incomplete” and fails to include it in the QIF download. This would be a problem even if it just involved total refunds where the refund cancels out the payment, but PayPal also fails to include any part of transactions that include only partial refunds as well. In other words, if a customer places a $100 order through an online store and is issued a $10 refund for a not in stock item, then both the order and the refund are not included in the QIF file, which puts the imported balance sheet $90 out of whack with reality.

Is this any way to run a financial institution that tries to act like a bank?

PayPal’s CSV files, on the other hand, do include every transaction, including transactions that receive a partial or complete refund. So I dutifully downloaded the CSV file and went to import it into HomeBank. Just as it did with the CSV files from the bank, the app refused to recognize it as a known file type.

KMyMoney, on the other hand, was ready to import the file, but when it came to telling the program what column was what, it crashed every time. I quickly came to the conclusion that this was likely caused by the fact that PayPal includes 20 or so columns of unnecessary information in the CSV download, so I opened the file in LibreOffice Calc and deleted all but the columns that would be needed by KMyMoney.

After that, the app let me go through the process of identifying Column One as the date, Column Two as the Payee and so forth without crashing, so I was hopeful that the import would work this time. Guess again. During the import process error messages flew left and right, and when the import was complete, KMyMoney was showing that I had a whopping $20,000 plus in the account, which I assure you isn’t anywhere near the case. I haven’t had that kind of money in any account at any time in my life.

As I said, I’m not the only one. Forums for both KMyMoney and HomeBank, as well as the forums for some proprietary money apps and PayPal’s forums, are filled with business owners tying to deal with the issues of PayPal’s QIF downloads being incomplete and its CSV downloads being impossible to import.

The way I see it, there are two ways for this issue to be resolved. The one that makes most sense is for PayPal to fix it by offering QIF, or better yet QFX, downloads that are complete with no transactions left out — as it should have done long ago.

Since it looks as if that’s not going to happen, maybe KMyMoney, HomeBank or another financial app will offer the import choice “CSV preconfigured for PayPal.” That would guarantee a large user base, as even the proprietary financial management programs experience this issue.

Meanwhile, since HomeBank doesn’t seem to recognize any CSV file as valid, I’m sticking with KMyMoney. And it looks like I’ll be spending time during the next week manually adding the transactions that disappear when importing as a QIF.

For the amount of money I have, it hardly seems worth it.

Christine Hall has been a journalist since 1971. In 2001, she began writing a weekly consumer computer column and started covering Linux and FOSS in 2002 after making the switch to GNU/Linux. Follow her on Twitter: @BrideOfLinux

I have never use Paypal except accidentally, and will never deliberately sign up for an account. That is being in a screen that uses PayPal as the Payment Gateway, but being fooled into creating a PayPal account by inattention to what’s going on. I still have PayPal emails coming through for the last time I did that, and had to cancel my Debit Card and get another one issued.

@ Tracyanne,

A FOSSForce funding drive or two ago, I came very close to donating… until I saw that it went thru paypal. I still have the email I got from indigogo asking what happened.

Unfortunately, my job tends to rain when it pours, and I’ll go from not enough hours to keep body and soul together were it to stay that way, to overtime, in days. When that happens I get strung out on lack of sleep and suspend most financial choices as I’m simply not functioning on enough sleep to make wise decisions. Equally unfortunately, it seems the timing of those things coincides with the FOSSForce funding drives, and by the time I’m getting sleep and sane enough to think again, the drive is over.

Of course I didn’t answer the “what happened” email either, for much the same reason.

It’s frustrating, actually. I hate to make excuses but when you’re functioning on about seven hours of sleep in three days… it’s just not a good time to try to make financial decisions, or once made, to try to navigate an unfamiliar funding setup that ends up gating thru something as untrustworthy as I consider paypal, and on that kind of sleep deficit good luck trying to make sense of EULAs, etc. At least you don’t have to worry about those with freedomware.

At least the banks have laws to follow and if your account is frozen there, you know you have far more serious problems than a frozen account! Not so with paypal, and every so often you read of a freedomware developer or project getting caught out by it, just because paypal didn’t like something or other about the way the funds were coming in. But there isn’t a lot of recourse because paypal isn’t held to the same laws as normal financial institutions.

I’ve faced doing the same check of open source bookkeeping systems for years as I manage the money for my church on an old 2009 copy of QuickBooks. So far I have no PayPal input but promised to add that option this year. As you know there is no direct export from QuickBooks into another system that is generic, their output is a proprietary format that only works on their system. The lists of open source bookkeeping programs show incomplete solutions I do not wish to adopt. This means I need to keep a Windows computer running just for this task. I’m curious if someone has found a real solutions from QuickBooks to open source??

Stew,

I use the OFX/QFX (QuickBooks) format from multiple sites (other than PayPal) to download transactions into KMyMoney routinely without issue. Take a look at that.

@Stew @Sid My experience is as Sid says. My download from the bank in the QFX format (labeled “QuckBooks) imported trouble free into both KMyMoney and HomeBank.

There is a solution for homebank:

https://kdecherf.com/blog/2013/12/18/import-paypal-transaction-history-in-homebank/

After reading your article I downloade dthe HomeBank software and took a look at the csv import function.

From the homebank documentatino I see this:

With HomeBank you can import/export some of the internal data’s in the most common file format that is CSV.

Notice: meanwhile csv should uses comma as separator, HomeBank uses semi-colon as separator (this is most common than comma)

The format used for the different files is specific to HomeBank, so don’t expect to import files your bank should offers you directly, you will need to arrange it a little in a spreadsheet like Gnumeric before.

So the program uses a non standard csv format and the columns should look like this:

date format must be DD-MM-YY

paymode from 0=none to 10=FI fee

info a string

payee a payee name

memo a string

amount a number with a ‘.’ or ‘,’ as decimal separator, ex: -24.12 or 36,75

category a full category name (category, or category:subcategory)

tags tags separated by space

tag is mandatory since v4.5

So to import a paypal csv file you would first have to reformat it for homebank.

I wrote a progarm (linux and windows) to easily convert paypal transaction history files to the required homebank csv file format.

Documentation and program can be downloaded from http://www.yooperlinux.com, menu link csvcr